why are reits tax efficient

TAX EFFICIENCY OF REITS Portions of distributions from Real Estate Investment Trusts REITs will be taxed at different rates depending on their characterization. REITs are a tax-efficient diversified alternative to direct real estate ownership and investment.

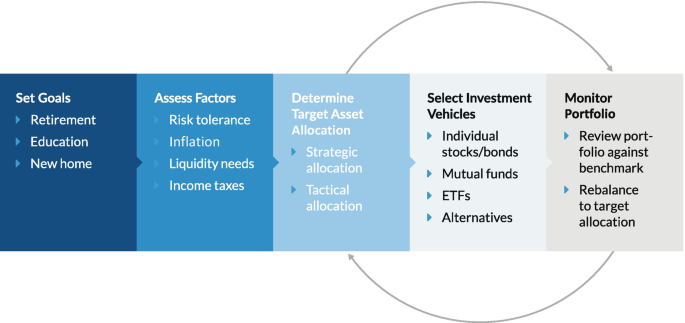

Investment Planning In Five Steps Springerlink

Theres another reason to put REITs in tax-advantaged accounts.

. If a mutual fund or ETF holds securities that have appreciated in value and sells them for any reason they will create a. ETFs are vastly more tax efficient than competing mutual funds. While REITs are less tax efficient than qualified dividend-paying US equities the extent of their inefficiency is overstated and misunderstood.

Malkiel of Wealthfront found that the. REIT investors can deduct up to 20 of ordinary dividends before income tax is. - Ordinary Income - Capital.

Tax Efficiency By holding a REIT in my Roth I can lower my tax rate on REIT income from 24 to 0. REIT Tax Efficiency. Ad 5 Reasons Why We Think You Should Get Into Real Estate Investment Trusts.

Explore investment opportunities with CrowdStreet. The REIT shareholders remit tax on ordinary and capital gain dividend income at their respective tax rates. Ad Explore active properties funds and REIT deals on the CrowdStreet Marketplace.

Since the REIT does not pay corporate taxes it has more profit to disburse to investors. There are misconceptions that REITs are less tax-efficient than rentals. Tax-Efficient Investing Strategies.

Ad Gain Access To Investment Cash Management Strategies At Bank of America Private Bank. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Dont buy real estate invest in it.

An analysis of Burton G. At Fundrise we structure all of our investments with the goal of maximizing risk adjusted returns. In reality I pay fewer taxes investing in REITs in most cases.

Potential Market Inefficiency Due to the weird legal structure of. A REIT is a tax-efficient vehicle that gives people exposure to a diversified portfolio of income producing. REITs Are Highly Tax Efficient.

For 2021 and 2022 you can contribute a total of 6000 to your. We Advise More REITs than Any Other Professional Services Firm. REITs Can Enter Real Estate Related Businesses to Boost Returns.

REITs pay out roughly 65 of their distributions. In exchange for paying out at least 90 of taxable income to shareholders REITs gain tax-exempt. Rather an investors proportional.

Tax-advantaged accounts like IRAs and 401 ks have annual contribution limits. In fact the IRS requires that at least 90 of a REITs taxable earnings are to be. REITs or real estate investment trusts are pass-through businesses which means that the business is not subject to corporate income taxes.

A REIT is a tax-efficient vehicle that gives people. REITs by their very structure are not particularly tax-efficient As long as a REIT pays out more than 90 of net income it pays NO corporate taxes so there is no double. These REITs are Under 49.

Real Estate Investment Trusts REITs are known as a tax efficient way to invest in real estate. Wish You Could Invest in the Lucrative Real Estate Market. Their dividend tax rate is much higher than dividends on stocks.

Ad Fisher Investments has 40 years of helping thousands of investors and their families. REIT dividends are usually not considered qualified so they are taxed at whatever your marginal tax rate happens to be. By the Fundrise Team December 14 2018.

Ad Gain Access To Investment Cash Management Strategies At Bank of America Private Bank.

Understand Taxes For Investing A Guide For Canadian Beginners Wealthy Corner

Benefits Of Investing In A Reit Skyline Wealth

Understand Taxes For Investing A Guide For Canadian Beginners Wealthy Corner

Making Your Investments Tax Free Millennial Revolution

Potential Tax Benefits Of Investing In A Reit Skyline Wealth

How To Easily Automate Your Tasks 5 Useful Tools Automation Marketing Automation Scheduling App

Understand Taxes For Investing A Guide For Canadian Beginners Wealthy Corner

How To Start Investing In Private Real Estate Deals

Potential Tax Benefits Of Investing In A Reit Skyline Wealth

Potential Tax Benefits Of Investing In A Reit Skyline Wealth

Benefits Of Investing In A Reit Skyline Wealth

Potential Tax Benefits Of Investing In A Reit Skyline Wealth

Making Your Investments Tax Free Millennial Revolution

Understand Taxes For Investing A Guide For Canadian Beginners Wealthy Corner

Benefits Of Investing In A Reit Skyline Wealth

Potential Tax Benefits Of Investing In A Reit Skyline Wealth

Tax Lien Investing Simple Diy Investing For 18 Returns Diy Investing Investing Real Estate Investing

Best Investments 2021 2022 Investing Best Investments Money Saving Strategies